The Real Cost of Compliance in the Property Sector

Who regulates the Property sector? The financial and operational burden of Anti-Money Laundering (AML) compliance has long been a costly […]

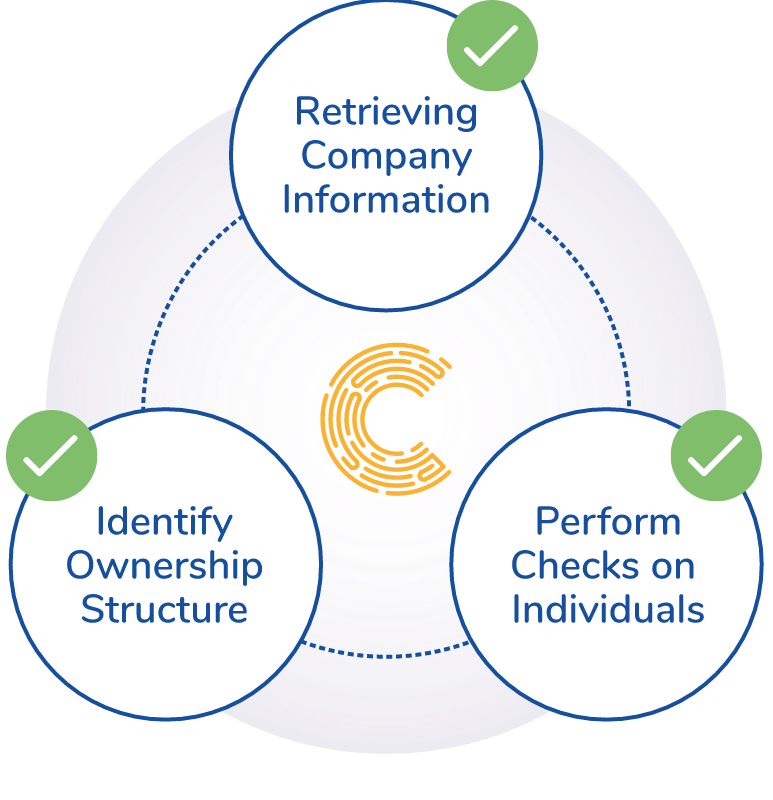

Credas is widely used by Company Formation providers to quickly and easily conduct checks on individuals wishing to set up a new company. Credas offers results in real-time for both the provider and the client and slashes the time spent on administration whilst providing a robust checking service.

Credas conducts thousands of checks each month on individuals setting up new companies and are an invaluable service to Company Formation Providers who wish to process customers quickly whilst remaining compliant. We use the latest technology and data sources to give Company Formation Providers peace of mind whilst also bring real efficiency to their onboarding process. From remote ID verification to PEPs/Sanctions screening Credas streamlines your customer due diligence process allowing your more time to grow your business.

Cutting edge biometric facial recognition technology delivering results in real-time.

Verify over 4,000 different types of ID documents using NFC or OCR technology.

Instantly check international PEPs and Sanctions databases and setup ongoing monitoring.

Easily manage your risk with our always on PEPs and Sanctions monitoring

With our Open Banking powered module you can easily gather financial statements in just a few clicks.

Put your brand front and centre with our white-labelling solution.

Easily integrate eSign documents into your onboarding process

Create your own forms using our drag and drop builder to collect key customer data

Company formation agents and trust businesses are under increasing pressure to carry out strict due diligence on their clients. Many of these businesses are struggling to meet HMRC’s expectations while delivering exceptional customer service.

Credas helps formation agents streamline their AML processes by automating tasks such as PEPs and Sanctions screening and document verification. Our end-to-end AML platform is capable of verifying ID documents from around the world and confirm claimed identities in just a few clicks. We’ve removed the need for manual data duplication with our simple, slick and smart mobile app that allows for quick remote client onboarding. We also offer easy integration with your own online system through our API meaning you can trigger invites automatically on application.

Our platform allows you to configure the client onboarding process to your specifications, ensuring that every client goes through the same rigorous checks without fail. You can choose what documents you want your clients to submit, what watchlists you want to screen against and even customise the branding. We also offer easy integration with your own online system through our API meaning you can trigger invites automatically on application.

Our starter package, monthly billing with one flat fee per search

Monthly billing & volume discounts, suitable for regular users

API Integration

Integrate Credas with your own systems

API Integration

Customisable solution for power users

Appears on sector pages

"*" indicates required fields

Who regulates the Property sector? The financial and operational burden of Anti-Money Laundering (AML) compliance has long been a costly […]

With money launderers targeting the UK, learn how long it takes to perform AML checks in our guide.

If you need help with understanding Enhanced Due Diligence, you’ve come to the right place. In this essential guide, we’ll […]