Helping formation agents meet their AML obligations

Credas is widely used by Company Formation providers to quickly and easily conduct checks on individuals wishing to set up a new company. Credas offers results in real-time for both the provider and the client and slashes the time spent on administration whilst providing a robust checking service.

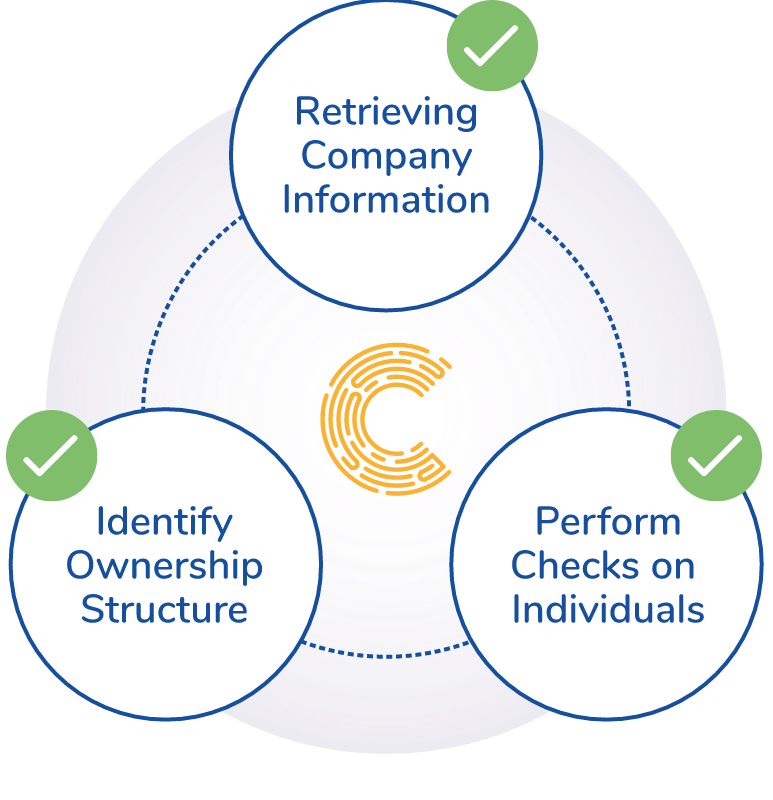

Complete CDD for Company Formation Agents

Credas conducts thousands of checks each month on individuals setting up new companies and are an invaluable service to Company Formation Providers who wish to process customers quickly whilst remaining compliant. We use the latest technology and data sources to give Company Formation Providers peace of mind whilst also bring real efficiency to their onboarding process. From remote ID verification to PEPs/Sanctions screening Credas streamlines your customer due diligence process allowing your more time to grow your business.

250,000+ appstore reviews

250,000+ appstore reviews