What is a PEPs and Sanctions check?

To start with, while they are often banded together, a PEP (Politically Exposed Person) check, and a Sanctions check are two completely different searches. One identifies whether an individual is listed on the sanctioned individuals list, the other whether the person is exposed directly or indirectly through a close relationship with someone in a position of political power.

Why and when would I need to conduct a PEPs and Sanctions check?

Under Money Laundering Regulations, regulated companies need to be aware of any PEPs they transact with. Not only do they pose a higher risk of criminal activity and thus require close monitoring and due diligence at all times, but there is also a chance they are a Designated Person (DP) and have official sanctions against them.

The easiest and most effective way of identifying if you’re dealing with a PEP or DP is to employ good anti-money laundering (AML) processes. Furthermore, using an AML system that facilitates the rechecking or ongoing monitoring of individuals is essential as PEPs & Sanctions lists are updated frequently.

This is vital because sanctions are more often assigned to individuals than organisations which means they’re not always easy to spot. In fact, according to government-issued sanctions data, 81% of all financial sanctions apply to individual people. Without automated ID and security checks, these individuals could easily slip under the radar.

What is a Politically Exposed Person (PEP)?

In the broadest sense, a PEP is a prominent public figure who has duties and responsibilities in which they are trusted by the general public.

The precise definition of a PEP varies from one country to another. But in the UK, examples of people who would meet the criteria are senior figures in politics, government, government-owned companies/organisations, courts, banking, law enforcement agencies, armed forces, and religious organisations.

As well as the high-profile individuals themselves, their family members, friends, or business associates can also be classed as RCAs, or Relative and Close Associates, because criminals might use them as leverage to bribe the high-profile figure.

Why are PEPs considered high-risk?

Put simply, PEPs are deemed to be more susceptible to bribery than your average person. Because of their high profile, and trusted positions in society, they are more likely to be targeted by criminals who wish to corrupt or take advantage of them. Often, criminals will bribe or blackmail PEPs to conduct or facilitate illegal activity.

Where can I find a database of PEPs?

Unlike government-managed sanctions lists, there is no single source of identified PEPs. Businesses

like Credas who provide PEPs checks usually interrogate several different data sources from around the world including Law enforcement lists and specialist databases such as Transparency International or Global Witness.

What information is contained in PEPs lists?

The data varies depending on the source which is where issues arise around false positives. Some sources include a full name, address, date of birth, and even an image which makes identifying and verifying individuals easy. While other sources may only include a name and nationality requiring further due diligence.

Why can’t I just ask my customers?

Asking your customer is a viable method to identify whether they are a PEP or sanctioned as part of your standard customer onboarding. However, you are required to verify this information, not just take their word for it.

You also need to take into account Relatives and Close Associates. In your onboarding do you also ask for

information about their parent’s profession or their business partners?

A PEPs and Sanctions check can also be a less obtrusive and time-saving method if part of an automated digital AML process.

Can I still work with a Politically Exposed Person?

Money laundering regulation do not restrict you from working with a Politically Exposed Person but it does require you to conduct Enhanced Due Diligence.

A politically exposed person is not a criminal. In fact, the vast majority of them are honest, hard-working people who serve the community in one way or another and are vital to the smooth running of society.

In the vast majority of cases, there will be no issues at all when working with a PEP, however, when working with a PEP or RCA you need to consider in greater detail their Source of Funds and Wealth. For example, an RCA may have been gifted their deposit by a PEP as a method to avoid direct scrutiny.

Who are considered PEPs?

PEPS aren’t just acting members of government but cover a wide range of roles such as senior military officials to board members of State-Owned Enterprises. Below are a list of key roles that fall within UK Government guidance when screening for PEPS.

Tier 1 – Head of States and Ministers…

- Heads of state and government (including Royal families).

- Members of government (ministers, deputies, state and under-state secretaries) at national and sub-national levels in case of federal states and provinces in China; President and College of Commissioner of the European Commission.

- Members of Parliament or similar legislative bodies (at national and sub-national level in case of federal states); Members of the European Parliament.

- Heads and top commanders of military and law enforcement and their deputies.

- Heads and members of supreme courts, of constitutional courts or of other high-level judicial bodies whose decisions are not subject to further appeal, except in exceptional cases; similar for EU Court of Justice.

- Heads and members of courts of auditors (including EU Court of Auditors) and of the boards of central banks (including the European Central Bank).

- Top ranking officials of mainstream political parties (e.g. party leaders and members of governing bodies) and only the heads/deputy heads of minor political parties (without representation in parliament).

- Relatives and Close Associates of PEPs within this bracket

Tier 2 – Senior political figures and judiciary…

- Members of legislative and executive bodies at regional, provincial, cantonal or equivalent levels (below the level of states in case of federal jurisdiction).

- Judges, justices, magistrates, prosecutors, attorneys in courts with jurisdiction at regional, provincial or equivalent level.

- Ambassadors, general consuls, high commissioners, permanent representatives, head of missions and their deputies, chargé d’affaires.

- Chairmen, secretary generals, directors, deputy directors and members of the board or equivalent function of international/regional organisations.

- Presidents/Chairperson and board members of State-Owned Enterprises (SOEs), businesses and organisations.

- Senior officials of the military, judiciary, law enforcement agencies, central banks and other state agencies, authorities and state bodies.

- Heads and senior members of mainstream religious groups.

Mayors of capital cities and Head of Cities which are directly appointed and answerable to the Chinese central government. - Relatives and Close Associates of PEPs within this bracket

Tier 3 – Advisers and middle ranking diplomats…

- Advisers, heads of cabinet and similar roles of senior officials of the military, judiciary, law enforcement, central banks.

- And other state agencies, authorities and state bodies (designation/level to be determined depending on country ML/TF and corruption risks profile and administration structure).

- Heads and board members / senior officials of Trade Unions. In case of Chambers of Commerce and Charities a risk- based approach is followed.

- Presidents, secretary generals, directors, deputy directors and members of the board or equivalent function of international NGOs.

- Middle ranking diplomats (minister-counsellors, councillors, 1st Secretaries and 2nd Secretaries).

Alternate/deputy members of parliament/senate (not currently occupying seat). - Relatives and Close Associates of PEPs within this bracket

Tier 4 – Local political figures…

- Mayors and members of local councils at municipal, town, village or equivalent levels.

- Senior civil servants at regional/provincial or equivalent levels; senior officials of administrative bodies at local levels (directors/secretaries of city governments).

- Relatives and Close Associates of PEPs within this bracket

What are sanctions?

Sanctions are restrictive measures put in place to protect national security, maintain international peace, and stop money laundering activity, among other things.

The most common categories of sanctions include trade bans on certain commodities, sometimes including weapons, financial restrictions (such as asset freezes), and diplomatic measures (e.g., entry restrictions).

In the UK, sanctions are made under the Sanctions & Anti-Money Laundering Act 2018, otherwise known as the Sanctions Act. Its purpose is to impose serious restrictions on working or dealing with certain people or organisations known as Designated Persons (DPs). The list of current DPs is publicised through the UK sanctions list which includes all details on the exact nature of each sanction.

As a result, regulated companies, including estate agents, accountants and formation agents, are forbidden from dealing with DPs or any of their economic resources, no matter how legitimate the transaction might be.

An estate agent cannot, for example, sell a property to a sanctioned individual under any circumstances. If they do, they face severe legal repercussions.

What are the different sanction lists?

There are multiple different sanction lists, with each country keeping its own as well as centrally managed lists such as the UN security council list.

Some of main international sanction lists include:

- UK (HM Treasury)

- UN (Security Council)

- EU

- US (Department of State)

- US (OFAC)

As the UK is a member of the UN security council any changes to its sanctions list will be reflected in the UK HM Treasury list. While all entries on the UN security council list of sanctions will appear on the UK list there maybe be additional entries that are UK-specific.

Under UK legislation, businesses must check the HM Treasury list during their due diligence process though it is common practice to check all of the stated lists above which can be done easily via a AML provider.

How many people are on the UK sanctions list?

Sanctions lists can change daily depending on the global political climate. Currently, the UK imposes sanctions against over 3,500 different individuals and entities.

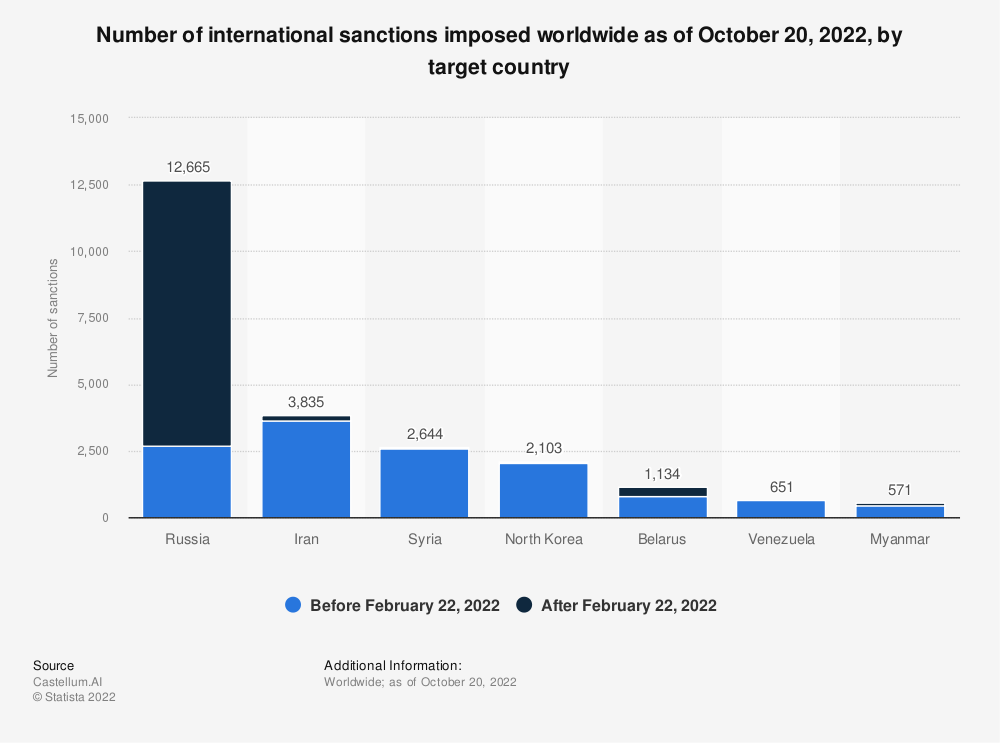

Individuals can be sanctioned due to their involvement in a range of activities including unauthorised drilling activities, human rights violations, cybercrime, or being part of a sanctioned political regime. The regime currently with the most sanctions is Russia with over 1,400 sanctioned individuals mainly due to their involvement in the War in Ukraine. As of the 4th October 2022, the UK has targeted over 120 Russian oligarchs with a net worth of over £130 billion through its sanctioning programme.

Can I still work with someone on a sanctions list?

Unlike working with a politically exposed individual, you cannot in any circumstance work with someone / an entity that is sanctioned. This extends to close relatives/associates who should also be on the list.

Punishment for breaching sanctions

If a company or individual breaches a sanction by, for example, accepting money from a sanctioned individual they have committed an illegal act and the Treasury has extensive powers to punish them.

Offending individuals can be imprisoned for up to seven years for dealing with a sanctioned individual, or companies can be hit with significant financial punishment

There is a specialist body within the Treasury that is responsible for enforcing these punishments. It is called the Office of Financial Sanctions Implementation (OFSI).

What is the best way to perform a PEPs and Sanction check?

There are two methods you can use to perform a PEPs and Sanctions check:

- Manually – by downloading the relevant lists and searching through them yourself

- Digitally – by using a third-party provider like Credas who will perform the search for you

While manually searching PEPs and sanctions lists is a possibility it’s neither efficient nor very effective. As mentioned earlier in this guide obtaining a definitive list of PEPs and sanctioned individuals requires merging multiple datasets from various sources. To do this manually would be extremely time-consuming and also prone to errors. You would also need to do this every day to ensure you’re using the latest official lists.

It is for this reason that digital checks have become the prominent method as they only take a few seconds to run and always use the latest data sources. Another benefit of digital checks is that they are inexpensive and can be run automatically as part of a predefined due diligence process. AML software can be set up so every customer is checked against the PEPs and Sanction list so nothing is missed.

Whatever method you decide to use it’s important you keep accurate records of when and how you checked whether a client was on any PEPs and Sanctions list. Again, digital checks make this task a lot simpler than manual checks.

Further resources

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017

https://www.legislation.gov.uk/uksi/2017/692/contents

UK Governement Sanctions guidance

https://www.gov.uk/guidance/uk-sanctions

EU restrictive measures against Russia over Ukraine (since 2014)

https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/

FCA – FG17/6: The treatment of politically exposed persons for anti-money laundering purposes

https://www.fca.org.uk/publications/finalised-guidance/fg17-6-treatment-politically-exposed-persons-peps-money-laundering

FATF Guidance: Politically Exposed Persons (Recommendations 12 and 22)

https://www.fatf-gafi.org/documents/documents/peps-r12-r22.html