We know that you love using Credas to carry out remote verifications, giving your customers the ability to verify in their own time, anywhere.

We also know that some clients prefer to visit you. Perhaps they aren’t tech savvy or have never taken a selfie.

Or maybe they enjoy a chat, a cuppa and a biscuit (who doesn’t?)

But what if a client does visit you at the office? Do you find yourself reverting to old habits and carrying out manual ID checks? You might think this is saving some cash, but we’re confident that’s not the case!

We All Do Inefficient Things!

How many times have you gone to the express supermarket to pick up something for dinner on your way home because you were too busy to check the fridge and cupboards?

Have you ever paid over the odds for a hotel, a flight, or a holiday because you’ve waited until the last minute to organise plans?

Of course – we all have – it’s just human nature, and it’s okay.

But when these inefficiencies become part of your business, everybody loses. Sales targets missed, profits hurt, morale dips.

The risk multiplies because bad or missing processes lead to safety issues, especially for regulated markets.

The Real Cost of Manual Checks

Did you know a manual check can cost you anything between £5–£30 each?

But when you consider the time spent – filling out forms, executing a procedure on paper, printing it, passing it around, scanning it, keying in data, storage, and in the worst-case time spent searching for a lost document when the regulator inevitably asks – the cost might be much higher.

Despite all this, many businesses continue to check documents manually – unaware that there are more efficient and risk-reducing alternatives available to them.

But, What Risk?

Could your business afford to pay a fine?

Research we conducted of Estate Agents and Anti-Money Laundering checks found the average fine by HMRC was £12,000, when assessed and considered non-compliant.

When completing a manual check, there are no guarantees that the document you’re verifying – often by sight alone – is genuine.

Are your staff trained to detect a fraudulent document? Can you spot the difference?

With our Face-to-Face solution, you and your employees can control the process on behalf of the customer while we reduce your risk by completing a detailed document check.

- Take a picture of the client (the Selfie).

- Take a picture of the ID document.

- Review the results in your portal.

In these three simple steps, Credas gives you peace of mind that both the customer and their documents are genuine.

What’s more, the verification is stored in your portal – accessible to you whenever you need it. With all data stored in our secure cloud environment, you can be sure you’re complying with GDPR.

Still Not Convinced

Still unsure that our Face-to-Face process is best for reduced risk?

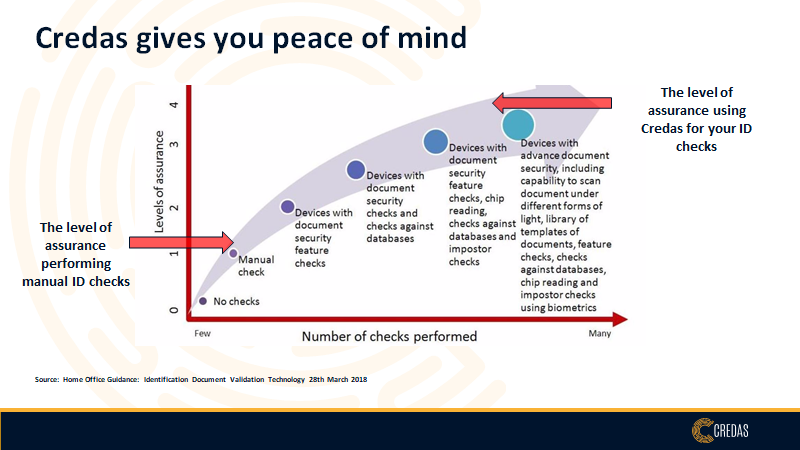

The graph below published by the UK government highlights the various levels of assurance associated with ID verification.

Source: Home Office Guidance – Identification Document Validation Technology

Credas sits above point 4 on the above graph, giving the added assurance that using our Face-to-Face solution can reduce risk to your business.

Day-to-day, we’re all up against it, working to tight deadlines, and growing business targets.

Ensuring that you demonstrate due-diligence and compliance is vital to protecting your business against financial and reputational damage.

The cost of not completing sufficient due diligence is much higher than undertaking a Credas check.

So, why wouldn’t you?

Next time your client visits you, be sure to use our Face-to-Face solution.

Your Simple, Slick and Smart way to reduce risk when verifying your client’s identity.