SMART SOURCE OF FUNDS SOFTWARE

Secure & verified statements in seconds

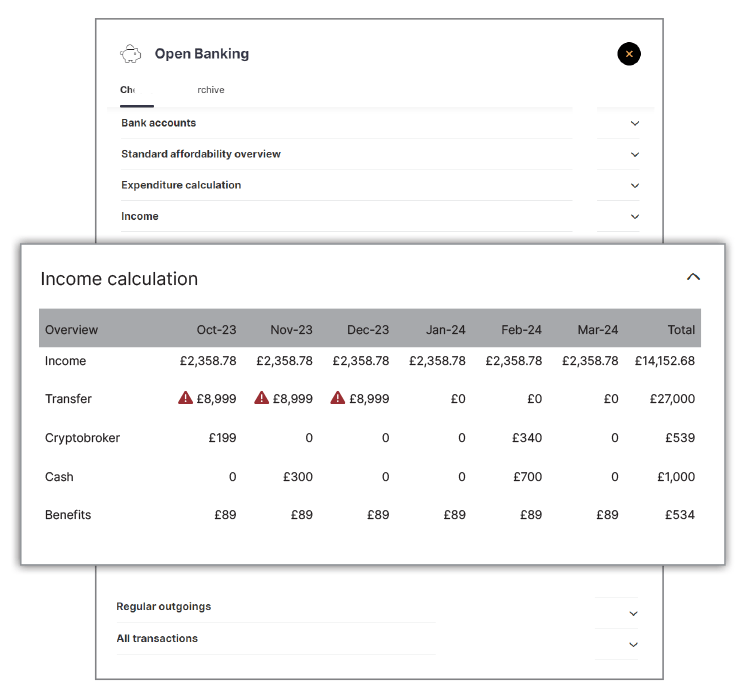

With our Open Banking powered reports, there’s no more need to search through pages and pages of bank statements. Instead, you’ll get verified financial insights in just a few clicks.

Our Source of Funds solutions uses cutting edge technology to reduce the burden of gathering and verifying your customer’s financial evidence.

Gathering Source of Funds using traditional methods can be a frustrating experience for both the customer and company. There is often a lot of back and forth, as customers send through paper documents which when reviewed don’t fully evidence may not be sufficient requiring additional requests and documents.

Get verified and analysed statements, instantly, with our Open Banking-powered Source of Funds software.

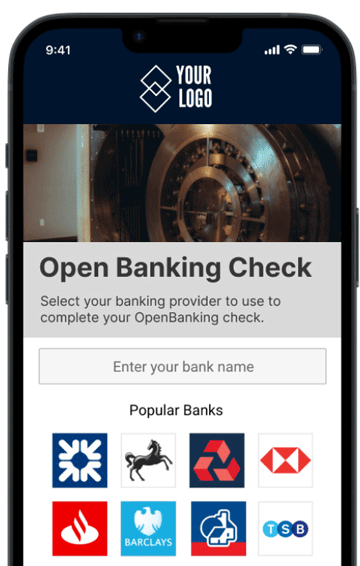

Our digital solution means you can stop chasing clients for bank statements and gather verified evidence instead. Our Open Banking solution connects with 95% of UK banks, allowing your customers to easily submit their financial statements which then instantly analyse for you.

Key Features of our source of funds app that result in Faster Financial Due Diligence

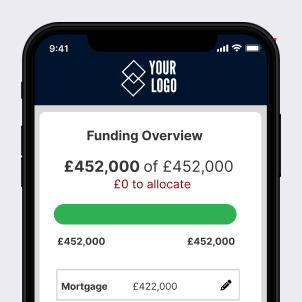

Dynamic funds totalizer

Often the simplest solutions are the best and that’s certainly the case with our funds totalizer. This simple visual aid helps ensure your customer submits sources that total the value of the transaction.

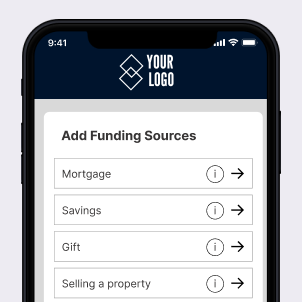

Smart Financial Fact-Finds

Instead of long, tedious questionnaires, your customer only needs to select the sources relevant to them, answer simple, relevant questions and provide an appropriate form of evidence

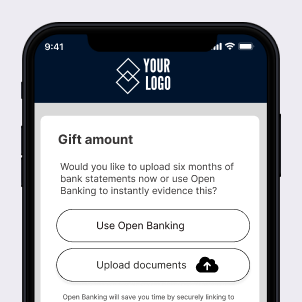

Uploads or Open Banking

Not everyone has online banking, so we give your customers the flexibility to choose between Open Banking or document upload when submitting their financial evidence, reducing the need to request additional documents.