Simple, Slick, Smart AML software

After more than three years of development and millions of pounds in investment, we can finally reveal the next generation of our sector-leading platform – Credas 3.0. By bringing together all the latest AML innovations under one platform, you no longer have to choose between being compliant and delivering an exceptional customer experience.Here's a sneak peek of our new platform

TRUSTED BY THESE COMPANIES

Don't compromise on customer experience or compliance

One platform for all of your AML needs

Free Proof / Source of Funds* with smart account analysis

Our new proof and source of funds module makes it easy for your customers to submit their financial statements online at anytime. Drive even more efficiencies by taking advantage of our Open Banking powered automated account analysis from as little as 45p an account.

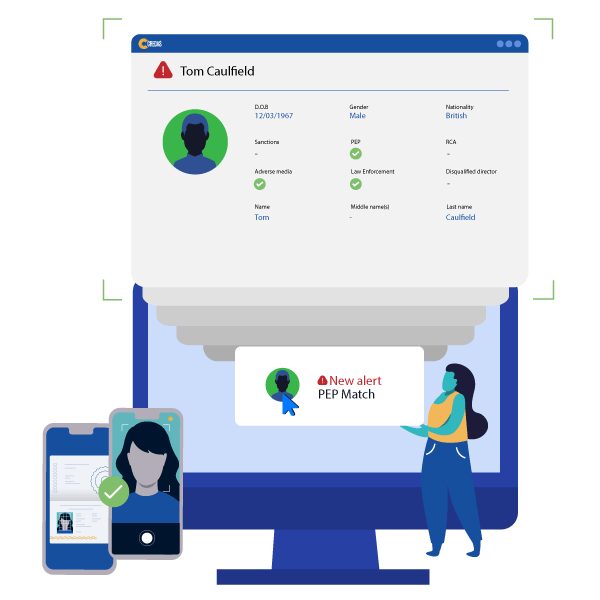

Enhanced PEPs & Sanctions results

Spend less time on false positives with the ability to toggle on and off datasets, matching methods and roles. Our new PEPs & Sanctions results now include headshots, adverse media and law enforcement checks at no extra charge.

Put your brand front and centre with our branding module

Our custom branding feature allows you to customise everything from invite emails / SMS, to the end-user app, client portal and even PDF reports.

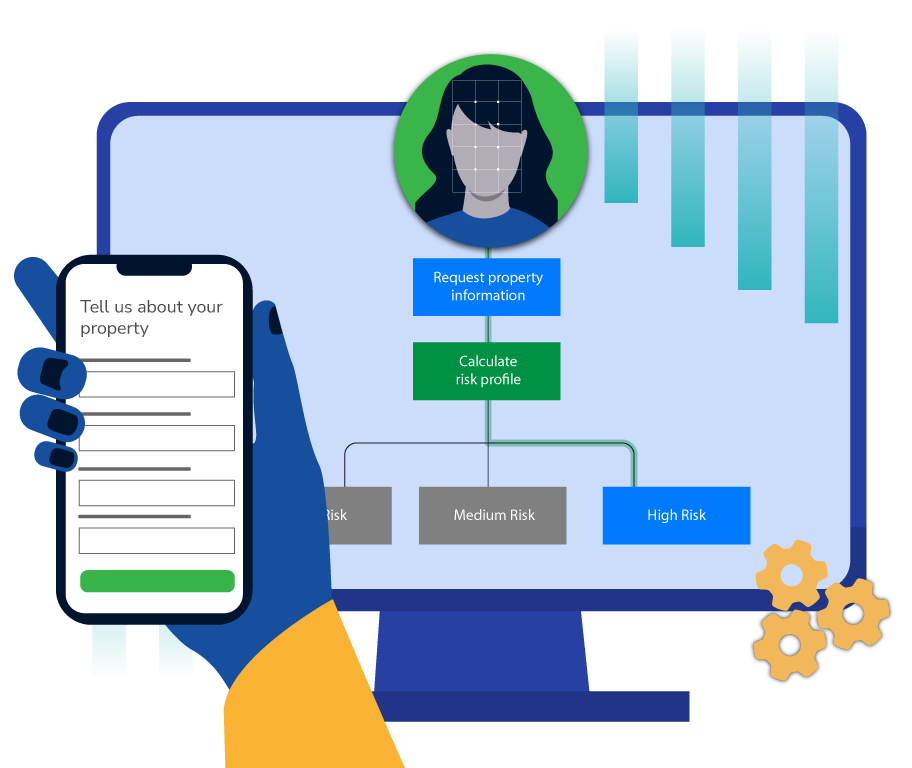

Take control of your compliance with our configuration engine

At the heart of our new platform is our powerful workflow engine which can be used to build bespoke processes to suit individual company needs. The workflow engine can combine custom forms, landing pages, IDV, data checks and eSignatures into one automated process capable of complex decisions / logic.

Complete the form to arrange a quick demo of our platform or call us on 02920 102 555

[contact-form-7 id=”11238″ title=”Sales Form Sector pages”]

*Charges only apply if your customer chooses to use the optional open banking method to submit financial statements. Charged at 1 credit per bank account. PDF/document uploads are free.

250,000+ appstore reviews

250,000+ appstore reviews