Credas is excited to announce our new payments solution; designed to help companies recoup some of the cost of compliance by charging their clients directly for their own verification checks.

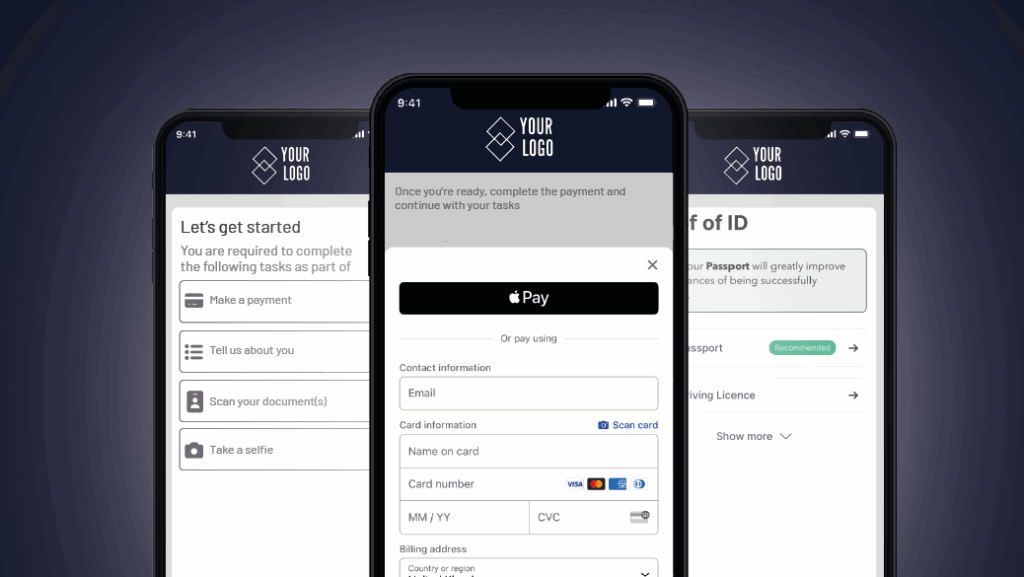

Unlike traditional client billing models which often involves offline invoicing, reconciliation and follow-up, Credas Payments is integrated directly into process, asking clients to complete payment at the same time as they complete their AML check, resulting in a single, seamless experience.

Key features of Credas Payments include:

- Flexible payment options

- Stripe powered PCI Level 1certified checkout

- Mobile and desktop compatible checkout

- Debit cards, credit cards and Google/Apple Pay accepted

- Refunds, charge-backs, declined payments all handled for you

The cost of being and staying compliant is a burden that has always caused a lot of strain. This is especially true for sectors like real estate and conveyancing that need to constantly onboard clients and run all verification checks. This new solution will come as a relief to the property sector as the cost of compliance continues to rise.

We are officially halfway through 2025, and already numerous new rules and regulations have been announced from both Companies House and the Office of Financial Sanctions Implementation (OFSI) regarding ID verification and Sanctions checks respectively.

Findings from a recent report we published found that the average independent firm is losing £16,000+ per year to compliance when considering registration fees, economic crime levy fees, direct and indirect staffing costs, plus the £3 million in fines issues by HMRC last year. Medium sized firms are averaging £70,000+ and large enterprises £200,000+. By using Credas payments, companies can level the playing field a little and turn a bill into an opportunity.

With no set up required, Credas clients can integrate Credas payments this instantly, with a flexible fee selection and the same hands-off approach. They send the invite, and we do the rest, including processing the payment, ensuring tax and VAT compliance, managing refunds and support and issuing a clear monthly rebate.