After more than three years of development and millions of pounds in investment, we can finally reveal the next generation of our sector-leading platform – Credas 3.0.

Our brand new platform delivers a number of new innovations that will simplify due diligence for both businesses and their customers, while reducing the risk of fraudulent/criminal activity.

Property professionals and regulated businesses will be able to take advantage of our:

- New branding module offering full branding that includes emails, SMS, landing pages, PDF reports & web app. Available as standard across all packages.

- Free proof and source of funds module including document uploads.

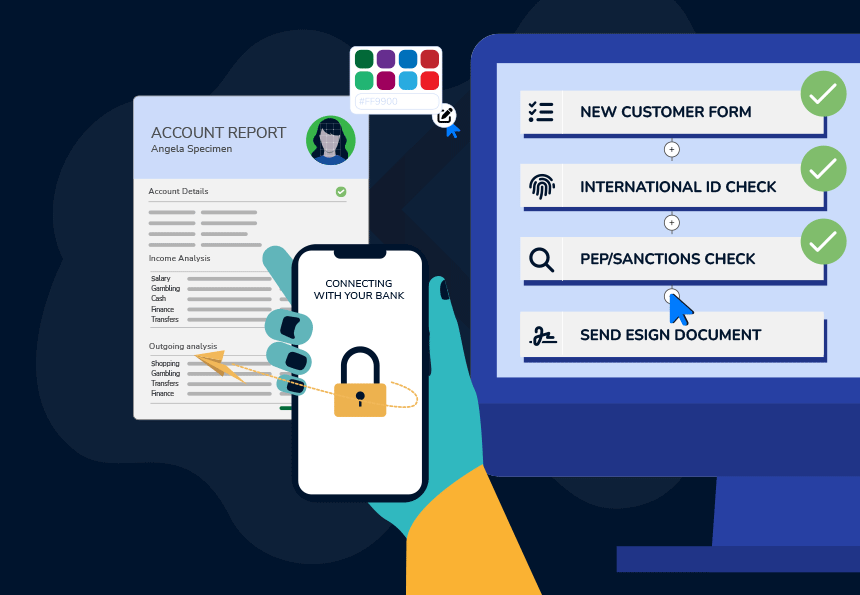

- New Open banking capabilities for automated account analysis from as little as 45p.

- The new Credas workflow engine that can create bespoke processes in hours not days.

- New fully integrated UK eIDAS advanced eSignatures.

- New PEPS and Sanctions results that include headshots, daily ongoing monitoring, adverse media, and law enforcement.

- New customisable data capture forms for bespoke client onboarding processes.

At the heart of our new platform is our powerful workflow engine which can be used to build bespoke processes to suit individual company needs. The workflow engine can combine custom forms, landing pages, IDV, data checks and eSignatures into one automated process capable of complex decisions / logic.

Our goal has always been to provide property professionals and regulated business with innovative technology that removes the burden of complex compliance processes. Advancements such as open banking, not only make it easier for customers to supply financial statements but it in turn, simplifies the processes for businesses and adds an extra layer of automation by instantly analysing the results.

We’ve invested millions into our brand new next-gen platform that provides agents with the very best AML tools, and a host of new integrations with the likes of Land Registry and LexisNexis.

The next-generation of AML technology is here…

Over 200,000 people a month are being processed by Credas with companies such as Connells, iamproperty, Stirling Ackroyd, Vouch, and Strike, enjoying the benefits of our brand new brand sector-leading platform.

By bringing together all these innovations under one platform, we’ve dramatically cut down the time it takes to onboard new customers while also strengthening a businesses’ compliance processes with our new data integrations.

Up until now there’s always been this sense that you couldn’t be compliant and also offer a slick customer experience but that’s no longer the case with our brand new next-gen platform.

If you would like a live demo of our brand new platform then click here.