Introducing Credas+, our new fully managed IDV / AML compliance service

To help regulated firms meet their money laundering obligations we have introduced our new managed compliance service, Credas+, which removes the burden of having to manually remediate AML & IDV results.

The new service offers a single comprehensive solution that delivers a pass or fail result, together with comprehensive compliance reports, including all the remediation evidence. Working closely with our existing clients we have built this new service to help reduce the risks and operational expenses associated with manually remediating AML/IDV results.

Tim Barnett, CEO of Credas Technologies commented: “AML searches often bring back a wide range of results that businesses must wade through. This is a crucial but also time-consuming task that many firms could outsource so they can focus on progressing the property transaction.”

When an ID or AML check requires further action our professionally trained team will determine whether the result passes or fails, by following an expertly designed remediation process.

Tim Barnett continues: “Unfortunately, estate agents and conveyancers have become the front line against money laundering, sanctions, and organised crime. Increasingly agents need to know their customers, which involves verifying their ID, identifying the source of funds, and PEPs/sanctions checks, which can be a time-consuming process. Currently, compliance is quite a slow and burdensome process for agents.

We have made a significant investment in our new Credas+ service, which combines managed outsource compliance for PEPs, Sanctions & IDV. The new service will help firms to reduce both their workload and the administrative burden of compliance.

Credas+ offers regulated firms a higher degree of certainty and security when dealing with customers knowing that all PEPs, Sanctions & IDV checks have been fully investigated .

How Credas+ works

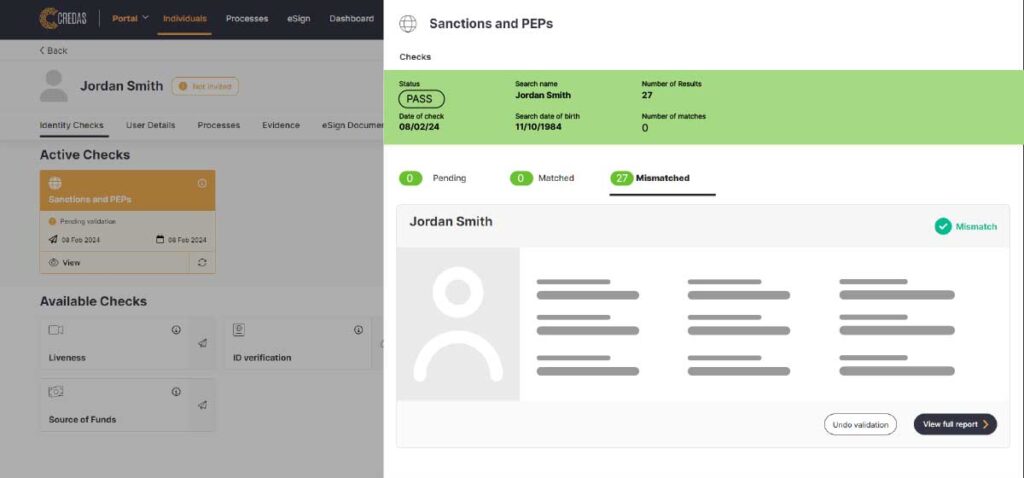

- Possible PEPS / Sanction matches are identified by our screening software

- Our team scrutinises the results and removes any false positives

- You receive either a PASS or FAIL result and rationale

What you get with Credas+

- Comprehensive compliance report that includes all remediation evidence

- Expert process designed by qualified compliance professionals

- Managed by professionally trained staff

- Fully remediated IDV results

- Fully remediated PEPs and Sanctions results

- Fully branded reports

- Indemnity cover against HMRC financial penalties

- PASS or FAIL results only