Customer Due Diligence is a requirement of anti-money laundering legislation as well as good practice for all businesses dealing with large sums of money.

But what exactly is Customer Due Diligence? How can you ensure you carry it out effectively and according to the relevant legislation? We’ll answer those questions and more in this simple guide to customer due diligence in the property sector and beyond.

What Is Customer Due Diligence?

Customer due diligence, also known as CDD, is a system of checks to help you get to know a client you’re working with. It’s about ensuring your customers aren’t involved in any illegal activity. It reduces the risk of fraud and is an important aspect of anti-money laundering (AML) regulations.

CDD helps you understand who the customer is, the source of their funds for the purchase or transaction, and any associated risks. It’s all about understanding your client as a person and the transaction as a whole.

CDD is a legal requirement in many areas of the property sector, but not all of them. For example, lettings aren’t subject to AML regulations if the monthly rental value is below 10,000 euros. However, it’s a good idea to carry out the relevant CDD checks to ensure that a potential tenant is who they say they are. Even when not required by law, CDD helps tackle fraud in general and can prevent firms protect themselves from being victims of fraud.

Stages in a Standard CDD Check

There are three essential parts of a standard CDD check:

- Confirm and validate the identity of the customer. You must certify that they are who they say they are to help prevent fraud.

- Verify the source of their funds for the purchase. You need to ensure they using funds from a legal source (e.g. income from employment for a deposit on a house purchase).

- Research any risks associated with the customer. Some people require additional checks to ensure there’s no risk of fraud, bribery, or corruption. These checks are known as enhanced due diligence. We’ll discuss this further below.

How To Do ID Checks for CDD

Checking a customer’s identity is a critical part of CDD. If you’re an estate agent, you need to ensure that the vendor is who they say they are to confirm they are entitled to sell that property. Likewise, you’ll need to verify that the purchaser is who they say they are and that they have a legitimate and legal source of funds.

To verify a customer’s identity, they’ll need to provide a piece of identification. You’ll then check that this is a valid piece of ID and confirm that it belongs to them.

What Types of ID Are Accepted for CDD Checks?

The best type of ID for a CDD check is photo ID, like a passport or driving licence. However, not everyone has photo ID, so combinations of other documentation, such as a utility bills and correspondence from local authorities are acceptable.

The documentation has to prove:

- The customer’s name

- The customer’s date of birth or address

Regulations stipulate that either the date of birth or address would be sufficient, but many organisations want proof of both for well-rounded due diligence checks.

With proof of their name, date of birth and address, you know who your customer is and how to contact them – meaning you can report them to the relevant authorities if any suspicious activity occurs.

Customer Due Diligence is effectively understanding who your customer is, determining the risk of that customer and based on that risk do more checks and more due diligence

Louis Lancaster

Checking the Validity of ID

Once your customer has provided a suitable piece of identification, you need to check that these documents are genuine and valid – and that they belong to that person.

Each CDD supervisor has a different way to check this. Most regulators require you to confirm you have a true copy of the original copy (i.e. by making the copy yourself). You can’t use WhatsApp or email to receive a copy, as you can’t be sure if it’s a true copy of a genuine document.

Certain regulators have additional rules. For instance, HMRC stipulates that you need to confirm whether a piece of photo ID is a good likeness of the person in question. To check this, you have to see your customer in person to verify that the ID is theirs. You can’t meet this condition if the customer’s spouse has brought their ID to your office, for example.

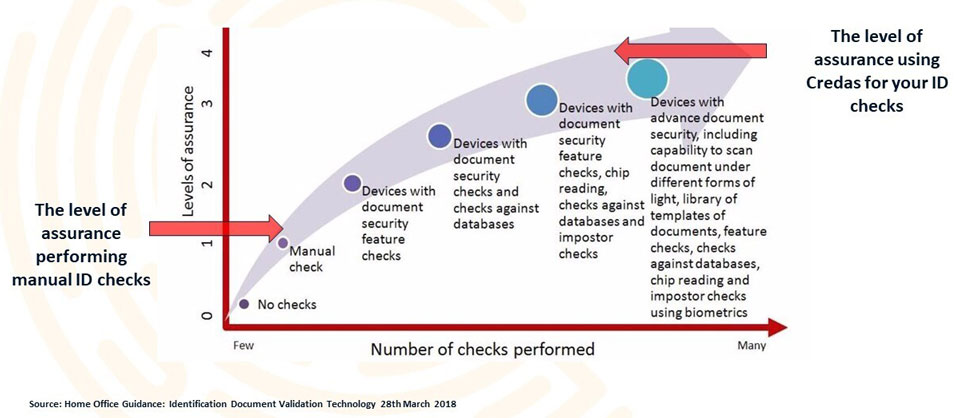

Checking the validity of ID can be time consuming, but the good news is that technology providers can help you verify ID remotely. Updated AML legislation from 2017 allows the use of technology providers to check ID, meaning there’s no need to wait for your clients to come into your office with a passport.

Who Needs to Go Through Customer Due Diligence Checks?

In a property sale or transaction, you need to conduct the Customer Due Diligence process on the purchaser and vendor of the property. However, it’s also important to run CDD checks on any ultimate beneficial owners (UBOs).

A UBO is any person that will benefit from the transaction. For example, when selling a house, the person or people selling the house are UBOs, as they’ll receive the money from the sale. The purchaser is also a UBO, since they’ll acquire a property.

But it’s not always as straightforward as that.

Let’s say an older woman lives in a care home but wants to sell her property. She might enlist the help of her son. If you’re an estate agent, you’ll deal directly with the son, and he’s your customer. However, it’s his mother in the care home who’ll benefit financially from the sale of the property, making her the UBO. In cases like this, you’d need to carry out CDD checks on both the woman and her son.

As another example, let’s say you have a young person buying their first property. If they don’t have much experience in the process, they might ask their parents for help. If most of your dealings are with their parents, you could forget to run CDD checks on the young person – even though they are the UBO acquiring a property. Perform your CDD checks on the parents and their child.

In certain situations, you might have people who want to avoid being part of the buying or selling process, using a proxy to sell or buy a property. It’s essential to run thorough CDD checks to ensure nobody involved is on any sanctions lists and is prevented from making this type of transaction. In cases like this, you might need to carry out enhanced due diligence.

What Is Enhanced Due Diligence?

Enhanced due diligence is a type of CDD check that goes above and beyond the checks you’d normally run. The specific checks required will depend on the reason for your enhanced due diligence check.

There are a few key factors within AML legislation dictating when enhanced due diligence should apply. These factors include:

- The geographical location of the customer or UBO. The government has a list of high-risk countries with poor or no AML legislation or practices. If your customer or UBO is based in one of these countries, you need to carry out enhanced due diligence.

- High transaction amounts. Higher amounts can be deemed high risk for fraud, so additional checks are required.

- Politically Exposed Person (PEP). PEPs, such as MPs, people working in public service, and heads of banks or world organisations, are often targets for bribery and corruption due to the power their hold. Enhanced due diligence is required for PEPs to help prevent financial crime and money laundering.

- Inconsistent information from the customer. If the customer has given inconsistent information about the source of their funds or you feel something suspicious is going on, it’s your responsibility to run enhanced due diligence.

It’s important to note that enhanced due diligence checks aren’t a simple check-box exercise. If something doesn’t feel right when performing your CDD, an additional layer of checks or questioning is always the right move.

Enhanced Due Diligence means going above what you normally do for that customer. Facts that might influence that are the geographic location of that customer or UBO for example.

Louis Lancaster

Types of Enhanced Due Diligence

The precise method of enhanced due diligence required will depend on the reasoning behind the enhanced checks. Proof of funds is the most common form of enhanced due diligence.

AML legislation says you need to determine the source of funds being used for a property transaction. Let’s say a buyer has a £20,000 deposit. Regular CDD would involve asking where that money came from. If the buyer says they have saved it up over 20 years of working full time, this doesn’t raise any alarm bells, and regular CDD is probably enough.

However, if it seems unlikely they would have saved £20,000 in the timeframe they say, you can request bank statements to see money coming in from their employer.

For PEP, enhanced due diligence could involve a thorough internet search to check for previous investigations into fraud, embezzlement or bribery. These adverse media checks can help you identify whether or not you consider them to be high risk.

Common Mistakes When Performing CDD

As you can see, there are various checks required as part of the customer due diligence process, and it can be tricky to get it right. A few mistakes arise again and again – here are the typical errors you need to avoid.

1. Poor Record Keeping

AML legislation requires you to keep a clear and thorough record of any CCD checks you perform. It often happens that an organisation carries out the right level of checks for a certain customer but fails to keep an accurate record of it. Without good record keeping, you can’t prove or defend that you’ve made the right checks.

2. Failing to Recognise UBOs

All organisations understand that they need to do CDD checks on the customer, but many don’t realise or forget to carry out those same checks on all UBOs. A UBO / Ultimate Beneficial Owner is anyone to set to benefit from the transaction, such as the sale of a house or business.

Let’s think back to the example above of the woman in a care home. In this situation, the woman could be someone who’s subject to sanctions. If you don’t do the right checks, you could be giving the proceeds of the sale to a sanctioned person – someone who isn’t legally entitled to that money.

A common tactic used by criminals / bad actors looking to avoid detection is use proxies such as a close relative or business partner to manage a transaction for them, hiding their involvement which is why is important to always investigate and establish a UBO.

3. Failure to Do Enhanced Due Diligence

Many organisations understand that they need to do PEP and sanctions checks but simply don’t know what to do if they have a positive hit. After running your standard CDD, if something comes up, you need to perform enhanced due diligence, document it carefully, and explain why you are satisfied to carry on with the transaction.

4. Incorrect ID Verification

It’s also common for organisations to fail to verify that the ID being presented for CDD checks does, in fact, belong to the customer. Some customers send a third party (such as a spouse or partner) to deliver their ID to the organisation. However, if you haven’t seen the customer in person, you can’t confirm that their ID is a good likeness – it could belong to someone else.

Since technological advances and changing legislation now allow for remote ID verification, you can easily avoid this type of CDD mistake.

Customer Due Diligence & AML

Customer due diligence is an essential part of AML in numerous sectors, including the property industry. It’s a legal requirement for sales and purchases, and it can help safeguard against fraud in the lettings market.

To carry out thorough CDD, always check and verify the ID of the seller or buyer and any UBOs involved in the transaction. Keep accurate records of all CDD checks, and don’t forget to take your CDD to the next level with enhanced checks if anything looks suspicious.

Podcast: What is Customer Due Diligence

How Credas can help?

We use the latest cutting-edge technology to help firms streamline their Customer Due Diligence. Our ID verification and AML checks help remove unnecessary manual process while ensuring a high-level of compliance, using up-to-date data from trusted sources. If you would like to learn more about our offering please contact us for a personalised demo.