In a significant move to enhance compliance and operational efficiency within the property sector, Credas, a leading provider of AML software, has announced a strategic partnership with proptech pioneers Offr. This collaboration aims to simplify compliance processes for agents while streamlining online auction sales.

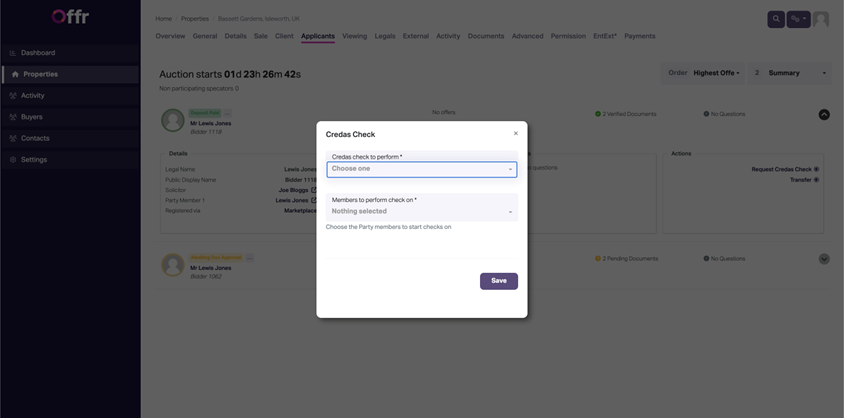

Credas has long been recognized for its cutting-edge AML solutions tailored specifically for the property sector. This integration simplifies the onboarding process, allowing agents to send out invites directly from the platform and receive the results instantly.

By incorporating Credas’ biometric ID checks and document verification into Offr’s platform, agents can expect reduced delays and heightened levels of certainty throughout the auction process.

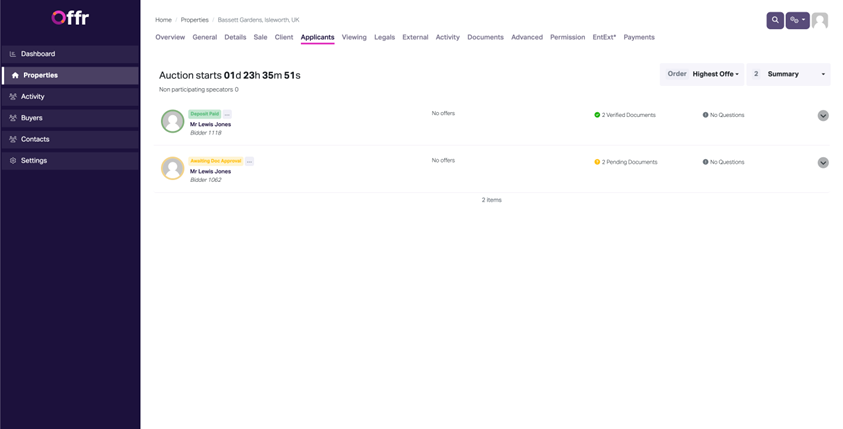

Offr’s platform provides agents with a centralized hub for managing the complete sales cycle from manging viewings to creating legal packs and can be easily embeddable into an agent’s website, allowing prospective buyers to quickly register their interest in a property. The new partnership provides agents with a centralized hub for managing their compliance and sales tasks efficiently, ultimately enhancing their overall productivity and client service.

One of the standout features of this partnership is the integration of Credas’ ID and AML checks into Offr’s activity timeline. This means agents can effortlessly track the status of any outstanding ID checks, ensuring transaction progress without unnecessary delays.

With compliance regulations becoming increasingly stringent, the partnership between Credas and Offr couldn’t have come at a better time for the property sector. By leveraging the combined expertise and technologies of both platforms, agents can navigate regulatory complexities with ease while focusing on what matters most: serving their clients and driving successful transactions.

By integrating Credas’ industry-leading AML solutions into Offr’s comprehensive platform, agents can expect enhanced transparency, reduced onboarding times, and greater confidence in their transactions. As regulatory requirements continue to evolve, this collaboration ensures that agents remain ahead of the curve, delivering exceptional service while meeting compliance standards effortlessly.

The integration can be easily activated by both Credas and Offr customers by reaching out to either party by clicking here.