Our research has revealed that interest in anti-money laundering has waned while regulatory fines have increased.

Our analysis of internet search trends has revealed that ‘economic sanctions’ and ‘politically exposed persons’ are the most searched anti-money laundering (AML) term in the UK, however, overall search interest in AML related topics is on the slide when compared to the start of the year.

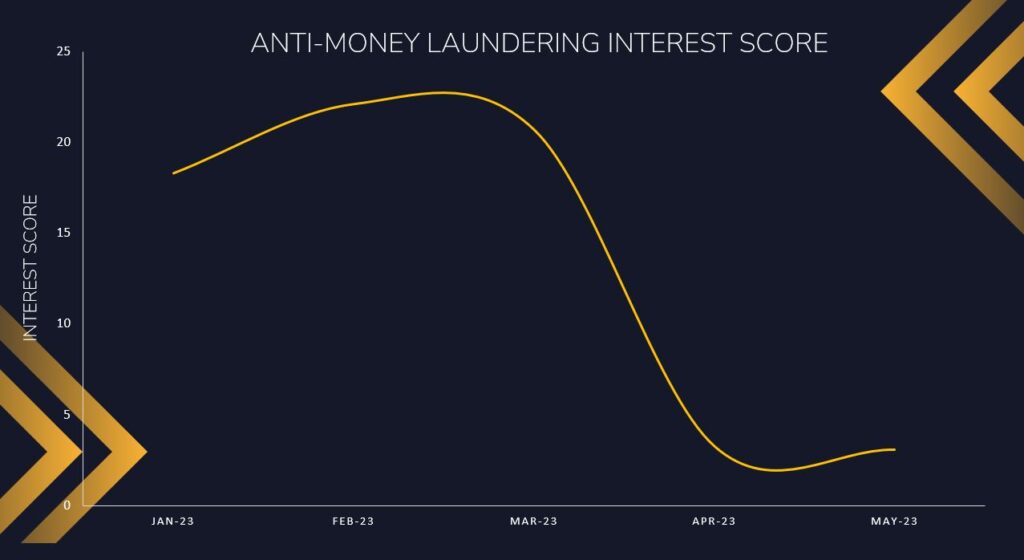

We analysed Google Trends data for nine search terms related to AML to see which has the highest Interest Score and is, therefore, of greatest concern to the nation.

Interest Scores represent search interest relative to the highest point on the chart for the given region and time. A value of 100 indicates peak popularity for the term. A value of 50 means that the term is half as popular. And so on.

Among the nine search terms analysed, the phrase ‘economic sanctions’ currently has the highest Interest Score of 45.5.

This suggests that professionals who are required to adhere to UK laws around AML, such as estate agents, are keen to better understand which nations and organisations currently have sanctions against them, perhaps as a result of sanctions against Russian investors since the full-scale invasion of Ukraine.

The search term ‘politically exposed person (PEP)’ has an Interest Score of 15.3 as professionals again seek to understand how they should engage with clients who could be classified as politically exposed. When such a person wants to invest in property, for example, UK regulators will want to keep a very close eye on their activity in case they are being manipulated by criminal elements.

‘Defence against terrorist financing (DATF)’ has an interest score of 15.1; ‘anti-money laundering’ scores 13.5; and ‘customer due diligence’ scores 11.8.

However, what is striking about the Interest Scores for these AML-related terms is the significant reduction in search popularity since the start of 2023.

Across the nine search terms, only ‘economic sanctions’ and ‘beneficial ownership’ have seen their Interest Scores increase by 1.2% and 101.1% respectively, while the remaining seven terms have seen a big drop.

This falling interest suggests that while AML remains an area of focus, this focus could be waning, opening up professional entities to risk of fines if caught asleep at the wheel.

While it’s understandable that professionals are less focussed on AML issues as Russian sanctions resulting from the Ukraine invasion, for example, have dropped down the news cycle – it is quite concerning to think that awareness and due diligence is on the decline.

AML is just as vital today as it was six months ago and any professionals who are failing to properly protect themselves and the wider UK economy from money-launderers or terrorist financiers risk falling foul of some very serious laws and regulations.

Modern technology means it’s now easy to practise proper AML due diligence and there’s no excuse to drop the ball, regardless of what time of year it is.