EASY ELECTRONIC KYC CHECKS

Speed up your KYC checks by automating your customer screening and onboarding.

REAL-TIME IDENTITY CHECKS AND DOCUMENT VERIFICATION

Widely used across the UK legal, finance and professional services sector, Credas provides biometric ID Verification and compliance checks so firms can meet their Know Your Customer quickly and efficiently.

Credas makes it easy for firms to identify high-risk individuals, delivering results in real-time from a large range of trusted sources tailored to your requirements.

TRUSTED BY THESE COMPANIES

KEY FEATURES OF OUR KYC CHECKS

Passiveness liveness to increase outcome rates

Verification of 2,500+ ID documents

Financial background screening

NFC document verification

Digital Address Verification

Company / director searches

Amberhill Police Database Checks

HALO database mortality checks

Source of Funds verification

SEE HOW IT WORKS

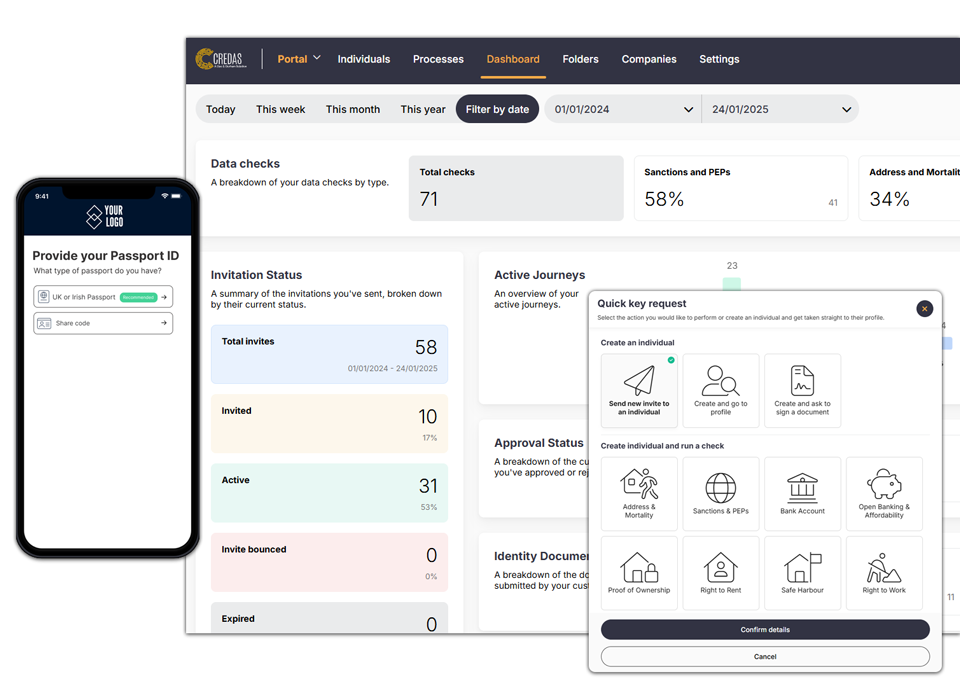

Verifying your customer’s identity couldn’t be easier with our simple, slick and smart ID checks. Our ID checking is as simple as send, snap, scan and submit. That’s it. We remove outdated processes such as uploading utility bills or bank statement as proof of address, replacing them with data enrichment from authoritative sources such as the electoral roll or credit bureaus.

HOW CREDAS HELPS STREAMLINE YOUR KYC CHECKS

Credas helps clients perform ID checks in real-time using a combination of cutting-edge biometric facial recognition and digital document verification. These technologies enable us to verify the identity of anyone, from anywhere in the world at anytime vastly reducing are often complex, expensive, time-consuming and resource intensive processes.

Credas enables firms to manage the complexity of onboarding and monitoring customers and employees while ensuring our clients meet their compliance obligations. ID checks can be completed through the industry leading Credas mobile app or via a standard internet browser

Stay compliant with our certified solution

As a certified Identity Service Provider under the UK Government’s Digital Identity and Attributes Trust Framework, we ensure rigorous compliance with all required standards.

Our independently assessed ID verification software supports the full spectrum of identity profiles, from low to very high confidence levels. It also meets the requirements of the Home Office’s Right to Work and Right to Rent schemes, providing reliable and secure identity verification solutions you can trust.

Whether you’re onboarding new employees, verifying tenant identities, or taking on customers we provide a seamless, efficient, and secure solution tailored to your needs.

Reduce operational costs

Replace manual processes with automated, customer led processes

Speed up outcomes

Automate screening and verification to onboard customers faster

Increase customer satisfaction

Replace manual processes with automated, customer led processes

REVOLUTIONISE YOUR KYC CHECKS

Verify Your Customers’ Identities with our digital ID verification technology

Book a demo - PPC

Appears on PPC pages

"*" indicates required fields