EFFORTLESS AML CHECKS FOR SOLICITORS

Streamline your client due diligence with cutting edge AML & ID checks.

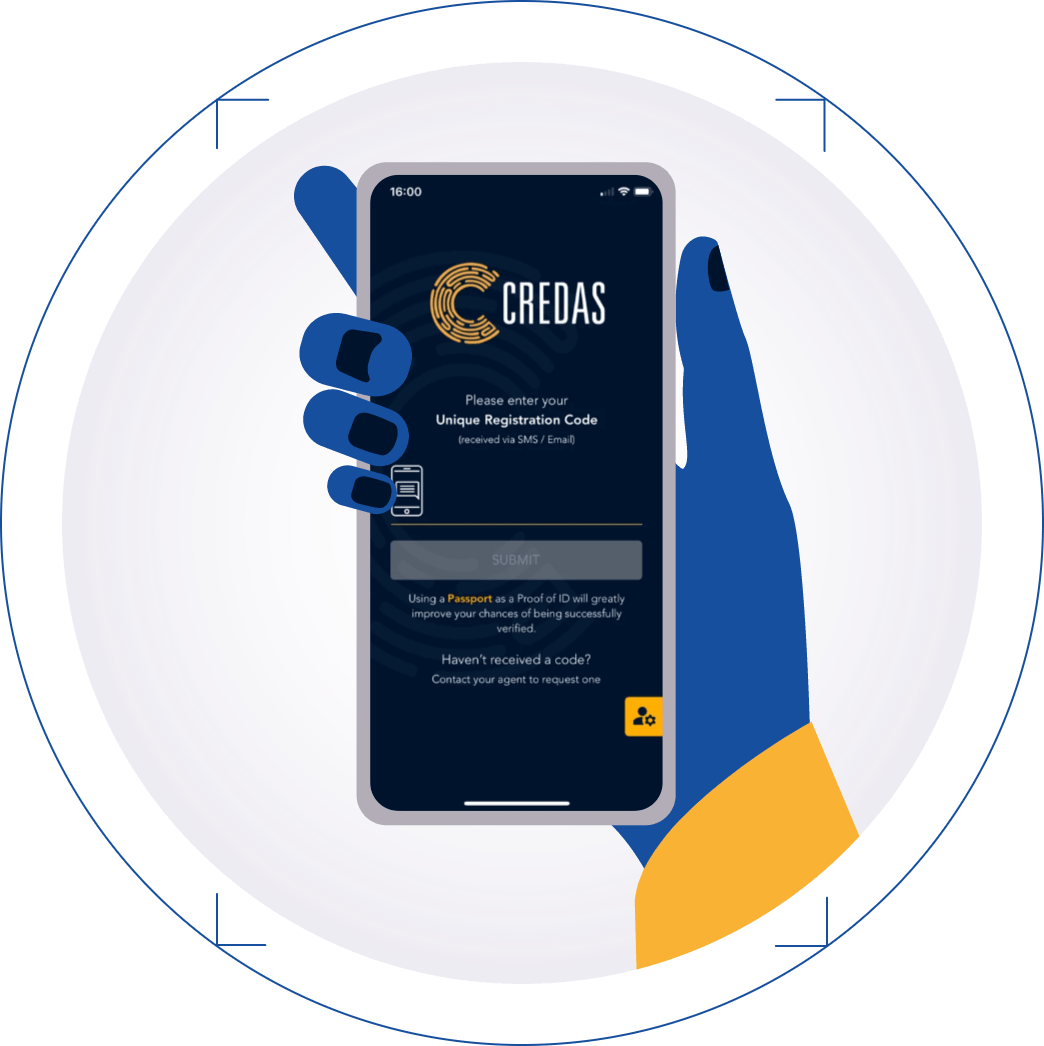

HASSLE-FREE ID CHECKS

Remove the delay and pain of customer due diligence checks with the simple, slick and sector leading Credas solution. With services specifically designed for the UK conveyancing and legal sector, including being the UK’s first Safe Harbour compliant provider, you can use Credas via our portal or integrate us in to your CRM, Case Management or any other internal system.

HOW WE HELP LAW FIRMS

Widely used across the conveyancing and legal sectors, Credas meets all the industry regulators standards including HMRC, SRA, ICAEW and JMLSG and is commended by the OPSS Regulatory Excellence Awards. We help conveyancers streamline the property purchasing process by providing real-time results which can be conducted remotely or in-person. Our technology means less data and more accurate results and easy PEP and Sanction searches.

- Safe Harbour compliant checks using NFC technology

- Verify over 2,5000 International ID documents

- Real-time PEPs and Sanctions screening

- Open-Banking powered Source of Funds

- Land Registry Integration Title Deeds checks

- Adverse media and SIP checks

- Proactive ongoing monitoring

- Custom branded portals

- Conduct checks remotely or in-person

- Easily exportable PDF reports

TRUSTED BY THESE COMPANIES

Why use Credas

- Verify anytime, anywhere with the user-friendly Credas portal and mobile app

- Safe Harbour compliant checks at no extra cost

- Used by many of the leading conveyancing firms and platforms

- All data stored within the UK with highest level security

- Simple, seamless API integration with your existing CRM or systems

- Low cost/low commitment tariffs

250,000+ appstore reviews

250,000+ appstore reviews