CREDAS PAYMENTS

Recover the cost of your compliance

Our built-in payments feature makes it easy for you to collect fees from your clients as part of their compliance checks.

From Overhead to Opportunity

Our new payments solution allows you to charge clients for compliance checks in-journey, recouping some of the costs involved in onboarding.

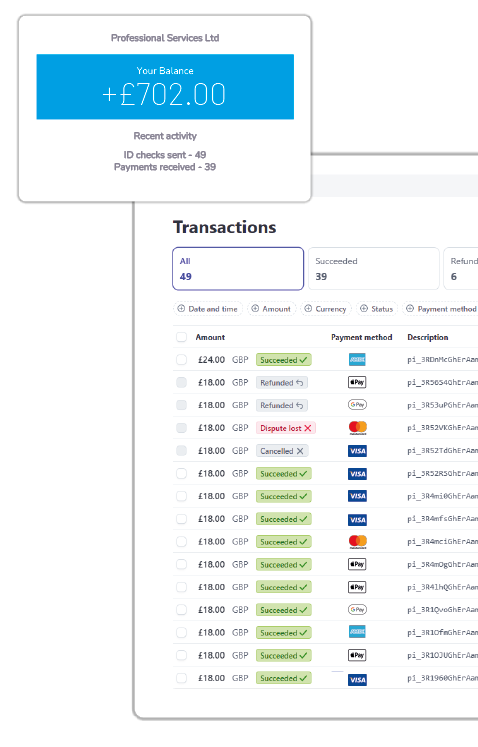

With compliance costs rising year on year, you could recoup some of the costs and even turn a profit by using our payments solution. There’s no risks or upfront fees and no technical setup; we handle everything from taking the payments, to managing tax compliance, charge-backs and customer refunds. In just one click you can turn an overhead into an opportunity.

Software and service combined

Our solution not only provides the software needed to handle and process payments but also the resources behind the scenes to support your customers.

Credas’ specialist payments team is on hand from morning to night to assist your customers with any payment queries, so you don’t have to worry about declined payments, payment fraud, charge-backs / disputes or having to issue full or part refunds. We’ll handle it all for you.

We also manage all tax compliance requirement, ensuring the correct amount of tax is collected based on their location and purchase, and that the appropriate authorities receive their share. This removes the burden from your business. The final result being a single statement showing exactly what you’re owed, that’s it.

Key features of our integrated payments solution

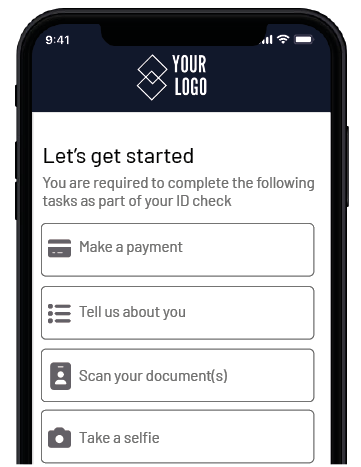

One easy, seamless experience

By integrating payments directly into the AML and ID verification process, you’ll see a higher uptake than the normal fragmented experience.

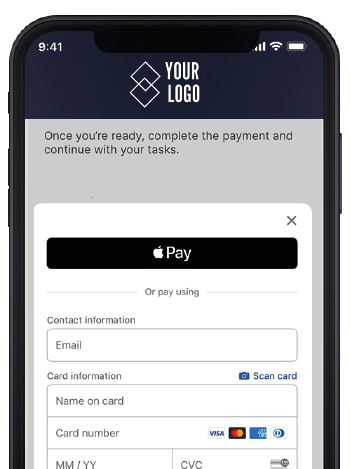

Browser & APP compatible

Designed for both app and browser, our solution offers a rich option of payment methods including Google & Apple pay as well as all major debit/credit cards.

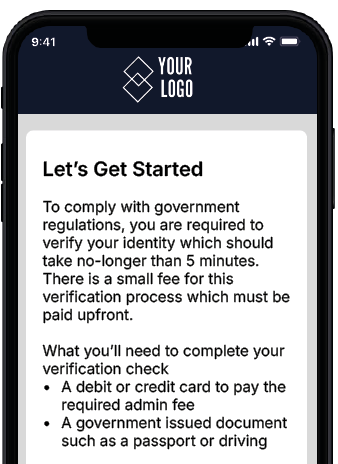

Custom branding checkout

With a checkout that looks and feels like your brand, your customer will never feel like they’ve stepped outside of your ecosystem helping to increase uptake.