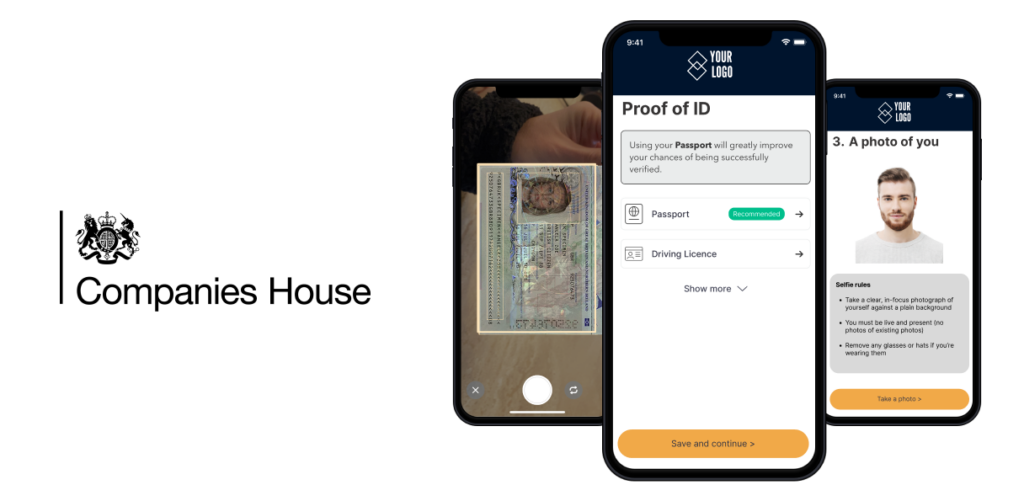

At Credas, we’re always looking for ways to make identity verification simpler and more efficient. That’s why we’re excited to introduce our brand-new Director Verification check built specifically in response to the new Companies House regulations.

The new regulation mandates that all company directors and Persons of Significant Control (PSCs) verify their identity, either directly with Companies House or through an Authorised Corporate Service Providers (ACSPs). Non-compliance could result in operational restrictions and financial penalties.

With over 6 million registered directors in the UK, the demand for identity verification solutions is expected to surge, significantly impacting ACSPs such as accountants and formation agents. Not only must these service providers adapt to the new regulations, but they must also continue to meet existing Anti-Money Laundering (AML) obligations.

Our new Director Verification checks are designed to streamline compliance, combining the latest Companies House standards with existing AML legislation. This dual compliance approach drastically reduces the administrative burden for ACSPs while increasing confidence in their compliance.

Tim Barnett, CEO of Credas, explained:

“Our new Director Verification checks ensure that firms and directors can meet these requirements efficiently and securely. By offering an alternative to verifying directly with Companies House, ACSPs can maintain direct client engagement and deliver a seamless onboarding experience.”

One of the features we’ll feel ASCP will really benefit from is our bulk invite solution. It lets you send out verification requests to your entire client base in just a few clicks—keeping things moving without causing delays or interruptions to your services.

We’re also proud to say that Credas is the highest-rated IDV app in the UK—with over 4 million downloads and more than 250,000 five-star reviews. We’re certified against the Digital Identity and Attributes Trust Framework, which means you can rely on us to provide the highest-standard of identity verification.

And because our platform is powered by an advanced workflow engine, we can adapt to new regulations incredibly quickly—configuring and implementing updates within hours.

Right now, verification is still voluntary, but that won’t be the case for long. Starting this autumn, all new or newly appointed directors and PSCs will need to complete identity checks. Everyone else will need to comply by autumn 2026.

With over 7 million registered directors in the UK, we know the demand for robust identity verification is only going to grow—and we’re ready for it.